Seamus O’Doherty is a director in BRG’s construction practice, as well as a chartered quantity surveyor, chartered builder and qualified adjudicator, arbitrator and accredited mediator with nearly thirty years of experience in commercial and project management and related disciplines. Here he explains that although construction output is up, it could take a while for a full recovery.

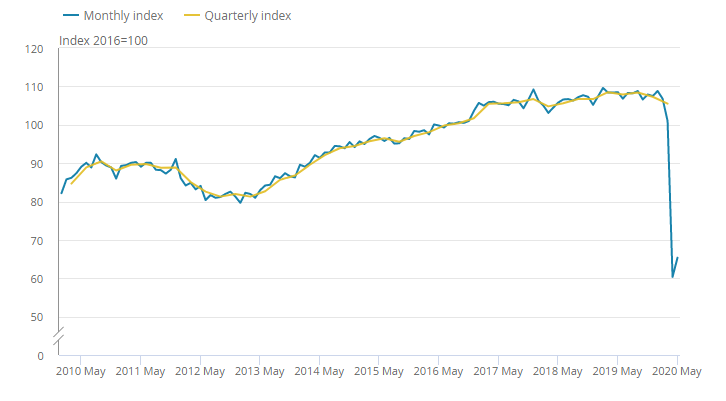

It is often said that construction is an economic bellwether, so recent data from the Office for National Statistics (ONS) showing that construction output in Great Britain increased by 8.2% in May 2020, when compared against the record decline of 40.1% recorded in April 2020, is a positive step forward for the recovery of the economy. However, significant challenges still lie ahead for the construction industry and a comprehensive recovery will take time.

Figure 1: Monthly construction output saw a partial rebound in May 2020 after the record monthly decrease in April 2020

Whilst the uplift is certainly welcome, it is not entirely surprising given the Prime Minister’s address to the nation on 10 May, when he eased the lockdown and actively encouraged those who cannot work from home (including construction workers) to go to work. The continuing efforts of the Construction Leadership Council (CLC) in addressing the serious practical issues of social distancing and undertaking construction works in its production and continual revisions of the Site Operating Procedures – Protecting Your Workforce, which is now in its fifth revision, also contributed to the partial economic rebound.

However, the May 2020 output figures, when compared with those from February 2020, show a respective reduction of 38.8%. Therefore, construction output has a considerable way to go just to match the pre-Covid output levels. The recovery will be exacerbated by the reduction in UK GDP experienced during the same period. The ONS has calculated that in the three months to May 2020 GDP has shrunk by 19.1%. During the 2008 financial crisis, UK GDP shrunk by no more than 2.1% in a single quarter. Thus, it is clear we are in unchartered waters.

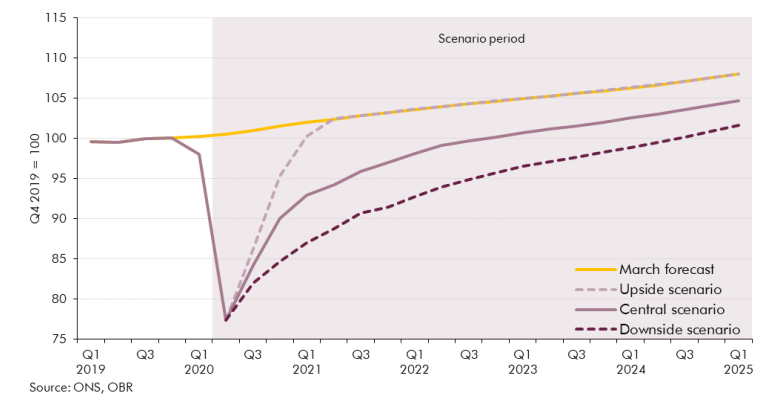

The Office for Budget Responsibility (OBR) also issued a fiscal sustainability report on 14 July, which sets out three medium-term scenarios for the economy and the public finances, based on different assumptions regarding the pace of the economic recovery and the extent of any lasting ‘scarring’ of economic potential. Even the upside scenario indicates nearly one year to approach the March 2020 forecast level. Moreover, the central and downside scenarios indicate that even by Q1 2025 the economy will not have recovered to the level forecast in March 2020. It is impossible to know how precisely the recovery will be shaped, however, there appears to be less support for a V-shaped recovery.

Figure 2: Real GDP versus March 2020 forecast

Whatever the difference of opinion concerning the shape and timing of the recovery, it is certain that there is a reduction of GDP. This reduction allied with the increasing costs associated with the measures undertaken by the government to combat the economic effects of Covid-19 by, for example, furloughing staff, short-term tax reductions to try to stimulate activity, and the likely tax increases in the near future means that the economy is in a fragile state. This fragility will impact the demand for the construction industry. In recognition of this the government announced on 30 June that it had brought forward £5 billion of capital investment projects under the mantra of ‘Build, build, build’. This is a welcome development, especially as circa £12 billion of output has been lost from March and May when measured against the output in February 2020, which was the last unaffected month before the lockdown.

However, we must remember that there will be a lag between the £5 billion spending announced, so it will not immediately replace the output that has been lost. For example, over £1 billion of the spend relates to a ten-year school rebuilding programme, with construction on the first sites planned to begin in September 2021. The construction industry therefore faces considerable issues in the medium to long term concerning obtaining sufficient work. This will, if other recessions are anything to go by, result in increased tendering competition and downward pricing as construction companies outbid each other to obtain work. The industry will also have to consider the impact of Brexit and the possible reduction in supply chains to a more regionally- biased one and the cost pressure that this may bring.

The construction industry is also facing significant challenges in the short term as it emerges from the lockdown into the ‘new normal’, and continues to grapple with the issues of sustained social distancing and its impact on productivity. Many projects currently underway are being completed in a landscape that has changed, and this will likely impact their financial viability, for example, possible reduced demand for office space due to the apparent success of working from home. The same could also be said for projects involving retail and leisure. Should the financial viability of projects be undermined, this will cause issues throughout the industry, especially if projects are suspended or terminated.

The projects that continue will also encounter potential headwinds. These include friction within the supply chain due to potential price inflation of products, as lines of supply and manufacturing have been impacted, as well as the consequences of Brexit and the possible discord with China. These may give rise to price pressures which contractors will not be able to pass on if the project has been procured on a fixed price arrangement. Should this occur, this will erode the notoriously thin margins forcing issues with the contractor’s cashflow and its ability to complete projects. This will be further exacerbated should contractors not be able to claim for additional time and loss of productivity incurred as a result of Covid-19. These issues, combined with the reduction in turnover, through the non-availability of new projects, and the corresponding failure to obtain enough cash to oil the business during the downturn will cause insolvencies.

On 1 June the CLC published a strategy, titled Roadmap to Recovery: An Industry Recovery Plan for the UK Construction Sector, which seeks to drive the recovery of the construction and built environment sectors, and through them the wider UK economy, following the Covid-19 pandemic and economic downturn. It aims to increase the level of activity across the construction ecosystem, accelerate the process of industry adjustment to the new normal, and build capacity in the industry to deliver strategic priorities, including: increasing prosperity across the UK; decarbonisation; modernisation through digital and manufacturing technologies; and delivering better, safer buildings. The plan has three phases to be delivered over two years:

- Restart: increase output, maximise employment and minimise disruption (0-3 months);

- Reset: drive demand, increase productivity, strengthen capability in the supply chain (3-12 months); and

- Reinvent: transform the industry, deliver better value, collaboration and partnership (12-24 months).

The CLC has set up four industry working groups to deliver the recovery plan and liaise with the government concerning strategy. The aims of the strategy are wide ranging and should, if implemented, assist in addressing some of the productivity issues that abound in the construction industry.

Overall, the recent construction output figures are encouraging although the industry faces significant headwinds as the socio-economic impact of the pandemic unfolds and Brexit looms. In the words of John F Kennedy “Change is the law of life. And those who look only to the past or present are certain to miss the future”. It is now time the construction industry and government look to the future and seize the opportunity to reshape the industry.

The post Output Up But Recovery Will Take Time appeared first on UK Construction Online.

Walang komento:

Mag-post ng isang Komento